Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

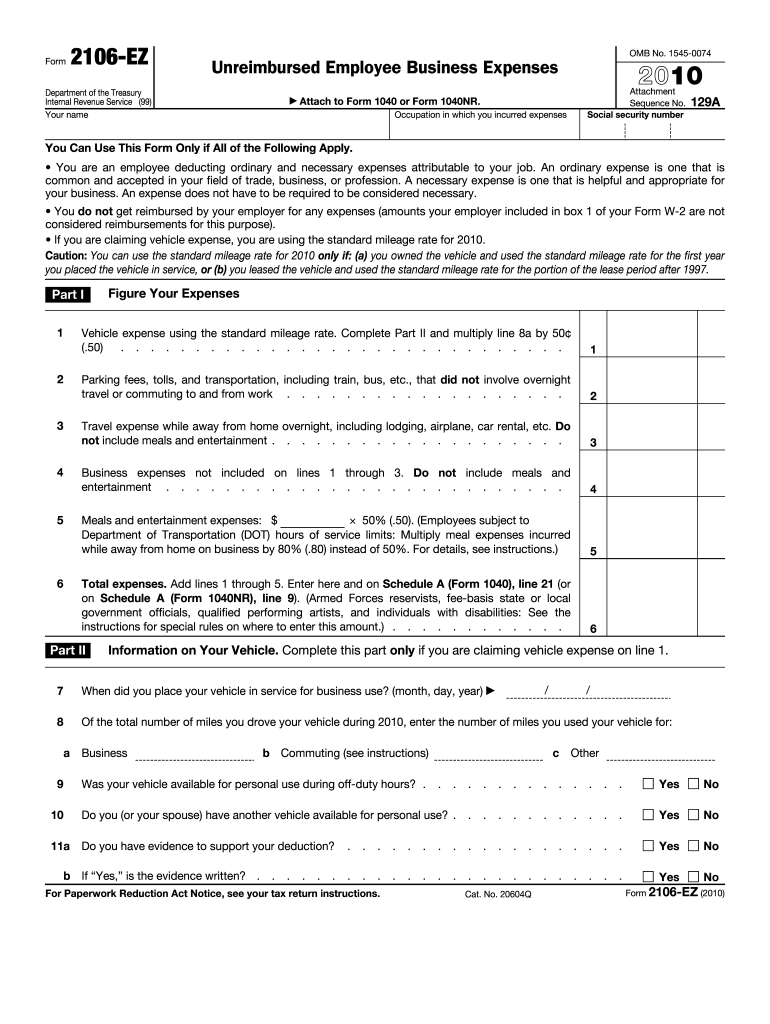

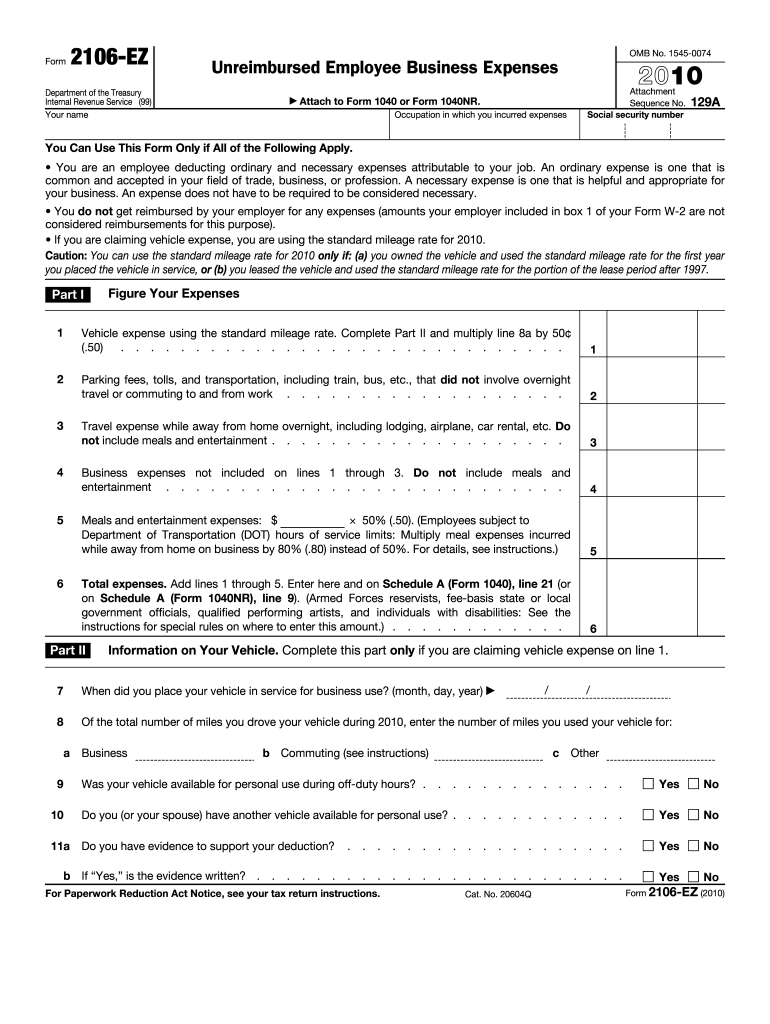

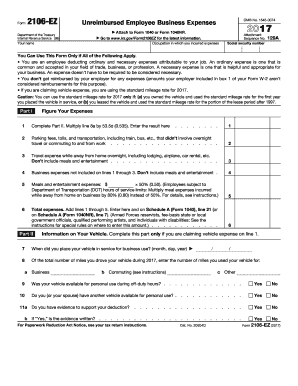

What is form 2106 pa inst?

Form 2106-PA-INST is the instruction form for Pennsylvania residents who need to complete Form 2106-PA, which is used for calculating unreimbursed business expenses. The instructions provide guidance on how to fill out the form accurately and effectively.

Form 2106-PA is used to report business expenses that are not reimbursed by an employer but are necessary for carrying out the taxpayer's job or profession. These expenses can include travel, meals, entertainment, transportation, and other costs directly related to the taxpayer's work.

Pennsylvania residents need to complete Form 2106-PA to calculate the deduction for unreimbursed business expenses they can claim on their state tax return. The instruction form helps taxpayers understand the specific guidelines and requirements for filling out Form 2106-PA correctly.

Who is required to file form 2106 pa inst?

Form 2106 PA is a Pennsylvania specific tax form used for reporting unreimbursed employee business expenses. Individuals who worked as employees in Pennsylvania and have deductible expenses that were not reimbursed by their employer may be required to file Form 2106 PA. This form is filed alongside the individual's Pennsylvania state tax return.

How to fill out form 2106 pa inst?

To fill out form 2106 PA INST (Pennsylvania Employee Business Expense Schedule), you will need to follow these steps:

1. Obtain a copy of form 2106 PA INST from the Pennsylvania Department of Revenue website or from your tax preparer.

2. Begin by providing your personal information at the top of the form, including your name, social security number, and filing status.

3. Next, you will need to enter your total reimbursed employee business expenses on line A. This includes any expenses that were reimbursed by your employer.

4. On line B, enter your total non-reimbursed employee business expenses. These are expenses that you paid out of pocket and were not reimbursed by your employer.

5. Calculate the total employee business expenses by adding lines A and B together and enter the sum on line C.

6. If you have any deductions related to the expenses listed on line C, you will need to provide details on Schedule UE-1, which is attached to form 2106 PA INST. Fill out Schedule UE-1 with the necessary information to calculate your allowable deductions. This may include details such as job-related mileage, travel expenses, meals, and entertainment expenses.

7. Once you have completed Schedule UE-1, transfer the total allowable deductions onto line D of form 2106 PA INST.

8. Subtract line D from line C to determine your allowable employee business expense deduction. Enter this amount on line E.

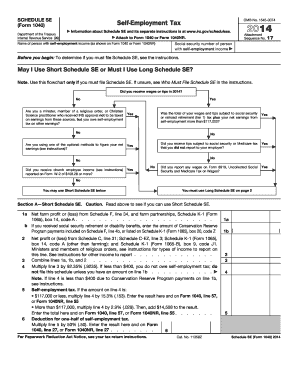

9. If you are operating a daycare business or have self-employment income, complete the relevant sections on lines F and G.

10. Finally, sign and date the form to certify that the information provided is accurate and complete.

Remember to keep all supporting documentation related to your employee business expenses, such as receipts and documentation of mileage and travel, as these may be requested by the Pennsylvania Department of Revenue for verification purposes.

What is the purpose of form 2106 pa inst?

Form 2106 PA Inst is the instruction booklet for Form 2106 PA, which is used by Pennsylvania taxpayers to claim unreimbursed employee business expenses. The purpose of Form 2106 PA Inst is to provide detailed instructions on how to complete Form 2106 PA accurately and correctly. It explains the eligibility requirements, allowable expenses, and any additional documentation or information that taxpayers need to provide when claiming these deductions. The instruction booklet helps individuals understand how to calculate their deductible business expenses and ensure they are in compliance with Pennsylvania state tax laws.

What information must be reported on form 2106 pa inst?

Form 2106 PA Instructions, also known as the Pennsylvania Employee Business Expenses, is used by residents of Pennsylvania who want to claim deductions for business expenses incurred in the course of their employment. The following information must be reported on this form:

1. Personal Information: Your name, address, Social Security number, and county of residence.

2. Employment Details: Information about your employer, including the name, address, and federal identification number. You also need to provide your job title, job duties, and the duration of your employment.

3. Business Expenses: The form requires you to report various business expenses that you incurred during the tax year. Some common categories of allowable expenses include travel expenses, meals and entertainment, transportation, supplies, and home office expenses. You need to provide detailed information about each expense, including the purpose of the expense, date, amount, and any reimbursement received.

4. Reimbursements: If you received any reimbursements from your employer or any other source for the reported business expenses, these amounts should be reported as well.

5. Calculating the Deduction: The form provides instructions on how to calculate your allowable deduction based on the reported expenses. This includes determining the percentage of business use for certain expenses, such as home office expenses.

6. Signature: Finally, you need to sign and date the form to certify that the information provided is true and accurate to the best of your knowledge.

Please note that the above information is a general overview and does not cover all possible situations or requirements. It is recommended to refer to the official instructions provided by the Pennsylvania Department of Revenue for detailed and up-to-date information specific to your circumstances.

What is the penalty for the late filing of form 2106 pa inst?

The penalty for the late filing of form 2106 PA INST may vary depending on the specific regulations and guidelines set by the Pennsylvania Department of Revenue. It is recommended to consult the official documentation or contact the department directly for the most accurate and up-to-date information regarding penalties for late filing.

How do I execute form 2106 pa inst online?

pdfFiller has made it simple to fill out and eSign 2010 form 2106. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my form 2106 or 2106 ez in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your form 2106 employee business expenses right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit ky form 2106 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like form 2106 pa inst. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.